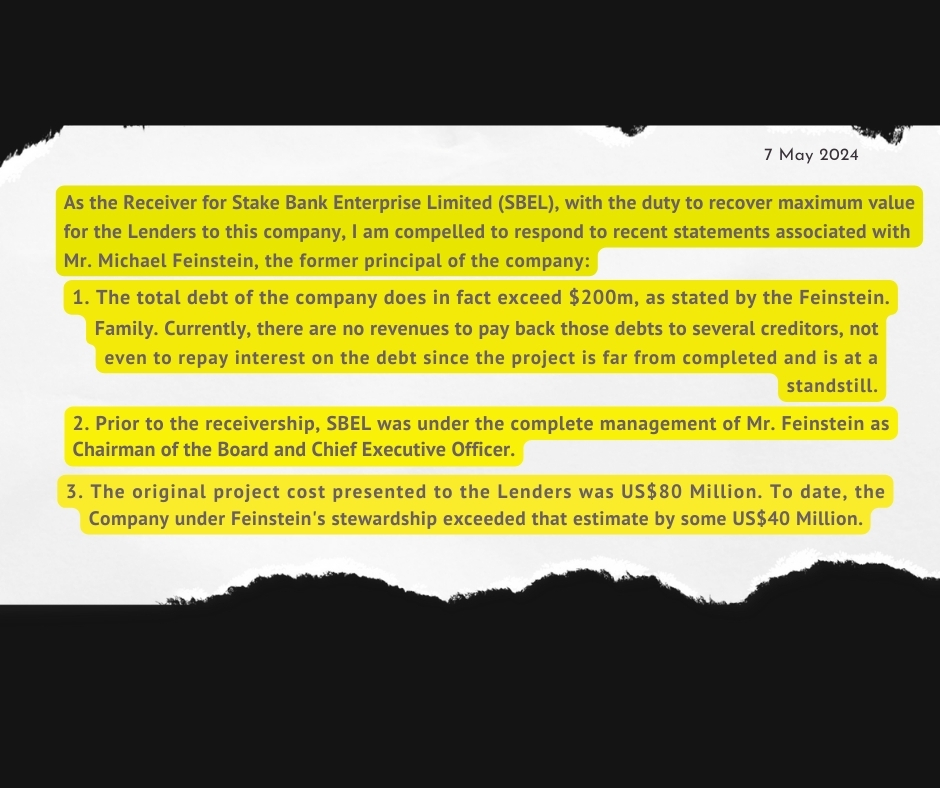

On Tuesday, Marlowe Neal, the receiver of Stake Bank Enterprise Limited, issued his own statement regarding the receivership ordered by Atlantic Bank and subsequent statements made by and on behalf of principal SBEL shareholder Mike Feinstein.

Neal clarifies that SBEL’s total debt exceeds BZ$200 million, while the original cost presented to the lenders was US$80 million. Neal says the company has exceeded that estimate by some US$40 million and shared that another US$70 million would be needed for the basic completion of the Port Coral project.

Neal adds that while the lenders had been told the security/collateral for the loans would be a finished functioning cruise port with “sufficient income to repay the loans,” the project is unfinished. Neal notes that they are getting an engineering audit done of the 70,000 square feet unfinished building and covered space to ascertain its value. According to Neal, there is an incomplete pier, unfinished dredging works, and material erosion of the reclaimed portions due to incomplete barrier protection.

The statement also affirms, “The project has no income and not a single cruise ship user agreement has been signed. The suggestion that potential buyers exist for the project is completely fictional. No buyer touted by Feinstein has even commenced due diligence.”

Neal also reveals that a forensic audit is being conducted of the spending of the lenders’ funds. It is preliminary findings of that audit which have led to a lawsuit for fraud against Feinstein.

The court is expected to hear the receiver’s application for an injunction on Thursday morning to stop Feinstein from disposing of assets, including the 23-acre extension to the original Stake Bank Island.